West Bengal Land Revenue Khajna Application 2026 Online

Land Revenue Khajna is important for the government; every land and property owner has to apply their land revenue khajna online (Apply West Bengal Land Revenue Khajna).

Citizens of West Bengal and property owners can easily make their BanglarBhumi Land Revenue Khajna Application online using the BanglarBhumi portal.

To apply for Land Revenue Khajna in West Bengal State, there is no need to visit any local office or land department. Anyone can do their land revenue khajna online just by using their land details.

Apply Land Revenue Khajna West Bengal 2026

On the BanglarBhumi portal, anyone can start a new Land Revenue Khajna application with some details and documents. Please follow the below steps:

Step 1. Visit BanglarBhumi Portal

Step 1. Visit the BanglarBhumi portal: https://banglarbhumi.gov.in/ and login to your account.

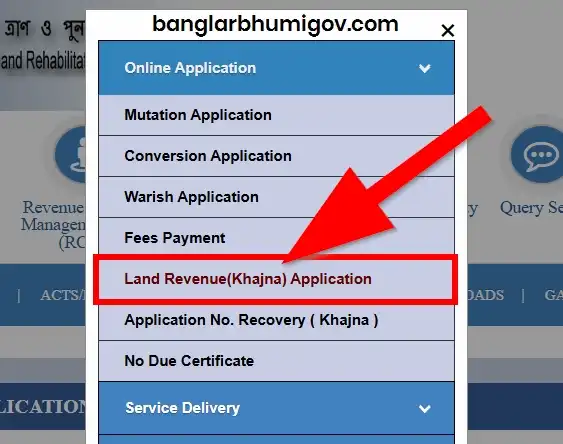

Step 2. Open Citizen Services

Go to the “Citizen Services” section and click on the “Online Application” option. Now click on the “Land Revenue (Khajna) Application” from the dropdown list.

https://banglarbhumi.gov.in/BanglarBhumi/RevenueApplication.action

Step 3. Open Land Revenue Khajna Application form

Step 3. After opening the Land Revenue Khajna Application form, select District, Block, and Mouza details. Now fill in the form below:

- Particulars of Applicant

- Revenue Deposition

- Un-Recorded Property Details

- Previous Land Revenue (Khajna) Details

Step 4. Particulars of Applicant

In this Land Revenue Khajna form with the details of applicants like applicant type, full name, Gurdain name, address, upovokta/beneficiary's number, EMail-ID, mobile number, Aadhaar number, gender, caste, and other details.

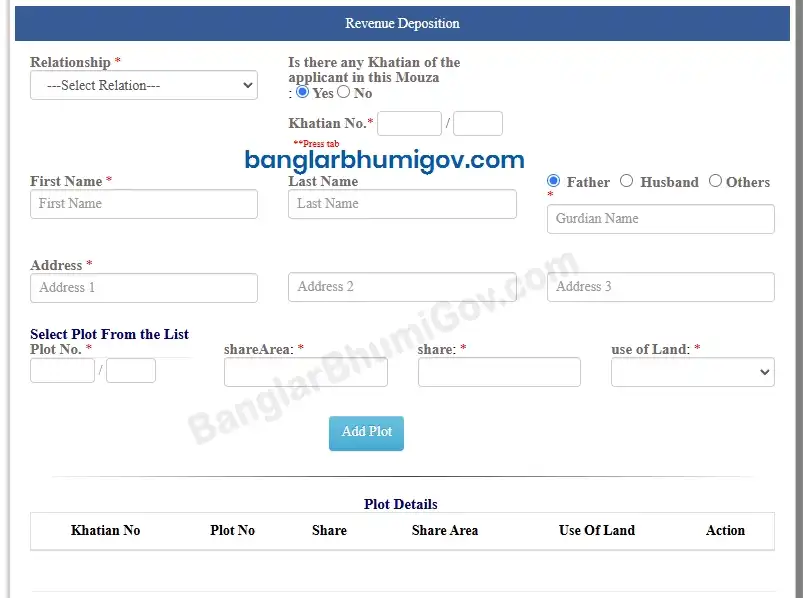

Step 5. Revenue Deposition

In the Revenue Deposition section, you have to add some important information about revenue deposit

- Relationship

- Khatian of the applicant in this Mouza

- Full name, Gurdain name, Address

- Plot Number

- ShareArea

- Share

- Use of Land

After giving all details, click on the "Add plot" button, and the plot details will be added to the below table. You can add multiple plot details using the same process.

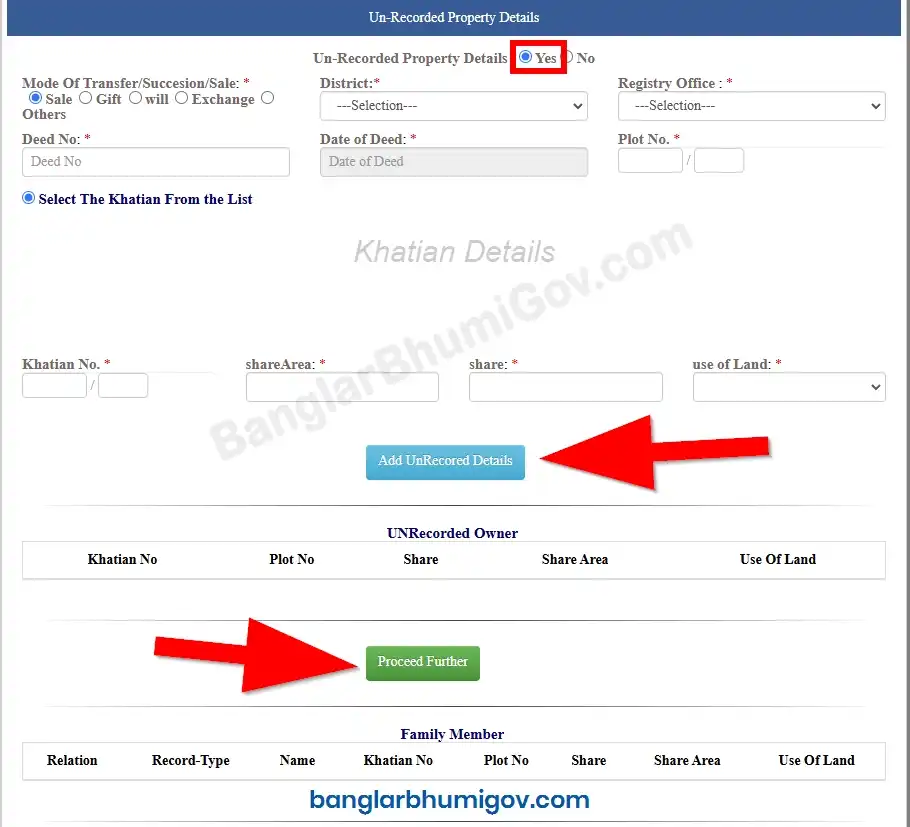

Step 6. Un-Recorded Property Details

In this Un-Recorded Property Details section, if you have any unrecorded property, then add all property details. (If you have no unrecorded property, just do in NO and you don't need to add any details.)

Let know if you have unrecorded property; you have to fill the form properly and add details of

- Mode Of Transfer/Succesion/Sale

- District

- Registry Office

- Deed No

- Date of Deed

- Plot Number

- Select The Khatian From the List

- Khatian Number, ShareArea, Share, Use of Land

After giving all details, click on the "Add UnRecorded Details" button to add the property details. If you have more than one unrecorded property, enter all property details one by one.

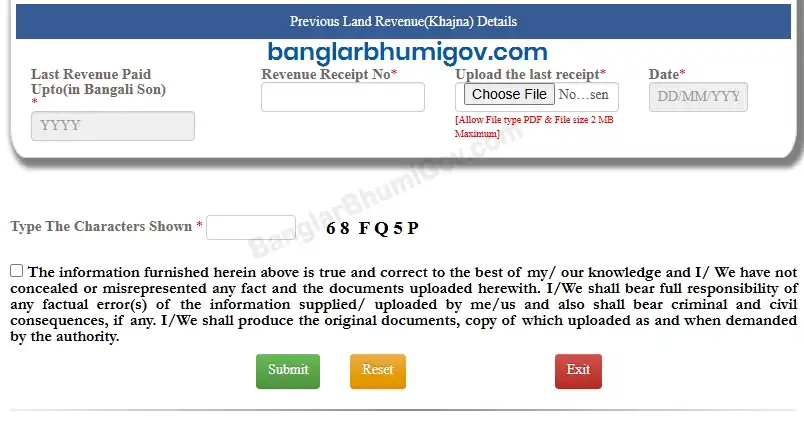

Step 7. Previous Land Revenue (Khajna) Details

The section of Previous Land Revenue (Khajna) Details provides some important information about previous land revenue and uploads a receipt. Add details of

- Last Revenue Paid Upto (in Bangali Son)

- Revenue Receipt Number

- Upload the last receipt (the receipt must be in PDF format and a maximum of 2 MB in size)

When you check all the details and fill out the Captcha code, click on the "Submit" button to complete the application.

For every type of land regulated or unregistered, the Revenue Khajna application can be done on the BanglarBhumi portal.

Land Revenue is important for any state and country; it also helps land and property owners to claim their property and land-related services.

Citizens of West Bengal can apply their Khajna online; the BanglarBhumi Revenue portal can make their application process easy and can do for their home.